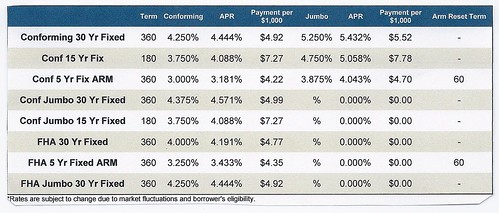

With rates as low under 4% for some home loans and auto loans at less than 3% in some cases, should consumers be jumping on the opportunity to borrow money?

With the economy struggling, many people are minimizing their debt. However, in the Pearland/Houston area with real estate taxes deductible at about 3%, the interest rates are nearly offset at their current marks!

So why aren't more people taking advantage of this opportunity?

1. Nearly 10% of all americans were unemployed in August. With many of those statistics being long-term unemployed at 27+ weeks. This factor has led many americans to be conservative with their money.

2. The housing market's future is volatile in most places. Homebuyers aren't sure as to whether their investment will be a wise one due to deflation and softening markets.

3. Qualifying for a loan is much more difficult than it once was.

It is true that bad and reckless lending led us to the state we are in now. However, if you are serious about owning a home, plan to be there for 5+ years, and have steady income and credit 620 or above, now is a terrific time to buy.

Be smart about your decisions and ask a realtor for more information and details.

Are the low interest rates enough to encourage a home/car purchase for you?

For more information from the original headline at msn.com click here