The Texas Quarterly Housing Report for the first quarter of 2016 has been released and the numbers suggest that Texas homes are currently in very high demand. Statewide inventory hit an all-time low in the first quarter, and these historically low numbers mean that Texas homes are now more in demand than ever. While inventory was down, Texas’ home sales and median home prices both increased when compared to last year’s first quarter. This is undoubtedly great news that some may find surprising since Texas is known as an energy sector-driven economy, but comes as no surprise to me when I think about how truly diversified the state's economy is. As the home of the Texas Medical Center, the Port of Houston, and countless other huge economic drivers, we will always see Texans, new and native, want to own homes here and prosper.

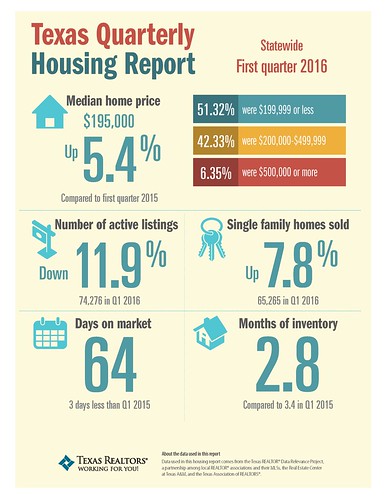

Housing inventory during the first quarter of 2016 dropped to a new statewide low of 2.8 months supply after being at 3.4 months in 2015’s first quarter. According to the Real Estate Center at Texas A&M University, a monthly housing inventory between 6.0 and 6.5 months is considered to be a fair balance between supply and demand. Texas’ inventory during the first quarter, which was less than half that number, clearly illustrates that housing in the state is in very high demand. With inventory so low, it was no surprise to see the year-over-year number of active listings drop significantly as well. Statewide, the number of active listings fell 11.9 percent from where they were during the first quarter of 2015.

The number of single-family homes sold in Texas during the first quarter of the year rose considerably compared to the first quarter of 2015, jumping 7.8 percent. Median price for single-family homes also grew a noteworthy amount year-over-year. Median price for 2016’s first quarter was $195,000. That amounts to a 5.4 percent increase over the first quarter of 2015.

While statewide numbers were a bit of a mixed bag, Houston’s housing market saw numbers rise across the board during the first quarter of 2016. 15,921 single-family homes were sold in the Houston metro area during the year’s first quarter. That’s an increase of 1.7 percent over the same period in 2015. Median price for single-family homes was also up, growing 3.5 percent, year-over-year. Unlike Texas as a whole, the number of listings in Houston during 2016’s first quarter actually increased when compared to the first quarter of 2015, rising 4.8 percent. Houston’s housing inventory increased a small amount as well, but only enough to match the statewide housing inventory of 2.8 months.

Buying or selling a home or simply want to discuss the market? Give me a call at 713.829.3052 or email me at cynthia@cynthiamullins.com.

...............................................................................................

visit my entire blog at http://blogs.har.com/cynthiamullins

client experience rating: http://goo.gl/bCoMo

email cynthia@cynthiamullins.com

follow me at www.twitter.com/cynthiamullins

friend me at www.facebook.com/cynthiamullins1

my stats: http://goo.gl/hFWEoR

see what people like about the Heights and what they think is its best kept secret at www.youtube.com/cynthiamullins