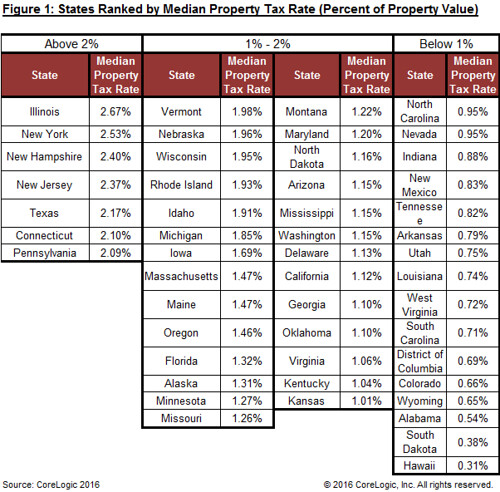

Ever wondered who is paying the highest property taxes? Well, according to data from CoreLogic, the median property tax rate nationally is 1.31%. That rate, applied to a $200,000 home, means the homeowner would pay an annual amount of $2,620. The median rate ranges nationally from the lowest (Hawaii at 0.31%) to the highest (Illinois at 2.67%).

The Corelogic report states, "While higher median tax rates are seen primarily among states in the northeast, a notable exception is Texas, which has a median property tax rate of 2.17%." The report goes on to note, "Typically, the states with the highest property tax rates, with the exception of Illinois, have multiple levels of tax collection. Conversely, the majority of states with the lowest median tax rates have a single level of collection at the county level. Other than Hawaii, the lowest median property tax rates are primarily in the Rocky Mountain region and southeastern states."

Main article: "Comparing the Real Cost of Owning Property Across the United States," CoreLogic's Insights Blog (04/27/16)