Buying vs. Building a House: The Ultimate Debate

December 31st, 2023

Share

Buying vs. building a house is the ultimate debate in the US real estate market. On the one hand, buying a house is the traditional and often more straightforward option. It's a popular choice for those who want convenience, established neighborhoods, and potentially lower costs. On the other hand, building a house from scratch is an opportunity to create a living space that meets your specifications and needs.

In this article, we'll explore the pros and cons of each option, comparing the two from various perspectives. Understanding these niceties should help you make an informed decision that aligns with your goals and budget. After all, it's an important decision that requires careful consideration and attention to detail. You need to factor in various aspects before you reach a conclusion.

So, let's find out whether you should build a house or buy an existing one.

Key Takeaways

- Buying a home is typically faster and less hassle, suiting those who need immediate relocation.

- Building usually involves higher initial costs and potential unforeseen expenses, whereas buying is generally more cost-effective in the short term.

- Building allows for personalization and modern designs, but buying offers more availability and variety in location choices.

- Securing a mortgage is often simpler for buying, but market conditions play a significant role in determining overall affordability in both cases.

- Building can offer long-term benefits like energy efficiency and higher resale value, though it demands more time, patience, and involvement in the process.

Buying a Home: Pros and Cons

Buying an existing home is the norm in the US. If you want to move into a place you can call home but don't have much time to invest in building a house from the ground up, then buying an existing home may be the right choice. However, buying an existing home comes with its own pros and cons. Let's have a quick overview of them before we delve into details and find out which option is likely to be the better choice.

| Pros |

Cons |

| It won't take as much planning. |

You might have to compromise on your wants. |

| It is typically a more cost-effective option than building a house. |

There may be more repair and maintenance costs than you might expect. |

| You can move in right away. |

You could face stiff competition from other potential buyers. |

| You have a well-maintained garden/lawn and an established neighborhood. |

The old design may not meet all your housing and environmental needs. |

Why SHOULD you buy an existing home?

Following are the five points to consider in favor of investing in an existing house:

- Choosing to buy a home might help you realize your dream of becoming a homeowner in a fraction of the time building one might take. The average time to buy a home can be anywhere from one month to half a year. However, you might want to hire a realtor to get the best options available on the market (and sometimes, even off the market).

- Generally speaking, the cost of buying a home is lower. It is a much cheaper option since buying an existing home does not include the design, material, and building costs. Moreover, it takes far less time to secure a mortgage to buy a house than to obtain a loan for a self-build project.

- Buying an existing house is a no-nonsense approach to becoming a homeowner. Once you purchase the right home, you can move in immediately.

- An existing house comes with many useful features. The house may already have a garden you can upgrade or plants around the property that would otherwise take years to grow.

- When you look for an existing house closer to amenities, you are more likely to shift into an already established neighborhood.

Why might you want to RECONSIDER buying an existing home?

There is always another side to a coin. Let's look at the risks involved in buying an existing home:

- Investing in an existing house may save you time but force you to compromise your vision for an ideal home. You cannot get so much out of a home not built for you.

- Houses built decades ago have gone through years of depreciation and wearing down. You might find repairs and issues later, even after an inspection.

- It may be challenging to find a home that meets both your needs and your budget.

- Environmental issues were not a serious concern a few decades ago, but they are now. Old houses did not incorporate energy-efficient or sustainable options in the building, for example, geothermal heating systems.

- Older homes may be packed with hazardous chemicals on walls (lead in paints) that were not considered harmful years ago. These might be some things to consider when buying an existing home.

What are the hidden expenses involved in buying a house?

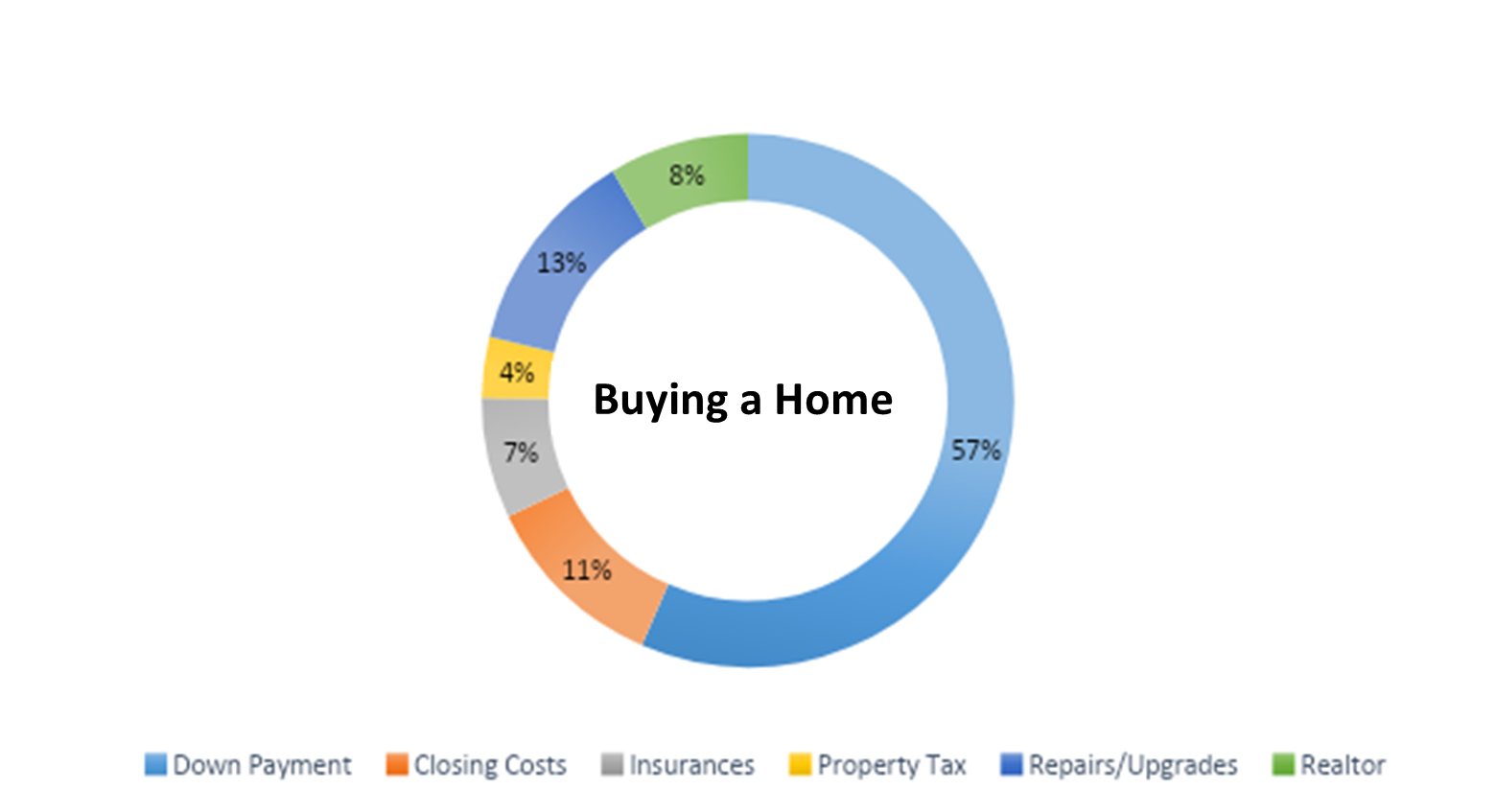

The median price of buying a home by the end of 2023 is expected to be marked at $380,000, according to Research on Statista. The chart below illustrates a breakdown of the common expenses involved in buying a home and how they contribute to the overall cost.

- Realtors on the buyer's side are typically paid less than those on the seller's. On average, 3% of the buying price of the house goes as a commission to the real estate agent. This constitutes about 8% of the total cost of buying a house.

- A sum of money that goes into the down payment is about 20% of the cost of the home. Simple math will betray that this makes up the highest portion of the house-buying costs: a whopping 57%.

- Closing costs are, on average, five percent of the loan and makeup about 11% of the total cost of buying a home.

- Monthly mortgage payments are bound to add to the overall expenses.

- Insurances include both mortgage and home insurance costs. Mortgage insurance is typically 1.5% of the loan (not the purchase price), while the average home insurance costs roughly $4200. For any year, insurance expenses account for 7% of the total cost of the house.

- Property taxes are essential for home buyers, even though they make up a small percentage of the total cost. Remember that even 2% of a price as great as $400,000 is $8000. Texas enjoys one of the lowest property taxes in the country, which may be an excellent incentive for a home buyer.

For first-time home buyers, it's important to note that several costs may be involved when buying an existing home. Below is a continuation of the list of expenses:

- Although major framing changes may not be necessary for an existing home, renovations, and upgrades may still be needed.

- An older house might need pest management along with repairs

- While the house may not be built for you, the interior design could still cater to your taste.

Buying a home usually has lower initial costs than building one. However, due to inflation, high demand, and intense competition in the housing market, it has become more challenging for buyers to invest in an already-built house.

Good news: A recent 2023 study predicts a significant drop in the cost of existing homes, which would be for the first time in a decade.

By now, you must have a good understanding of the costs of buying a home. Let's look at the other side: The nitty gritty of Building a House.

Learn More: Check out a Property For Sale Near You

Building a House: Pros and Cons

Building a house has certain pros and cons. On the good side, it offers the opportunity to customize every aspect of your living space, from location to design details, allowing for a unique reflection of your personality and lifestyle. It also allows you to integrate modern technology and eco-friendly features to reduce energy costs and align with environmental values.

However, building a house is a time-consuming and complex process that requires a significant investment of time, money, and effort, involving acquiring permits, securing financing, overseeing construction, and managing contractors. Not everyone can handle all this hassle and stress, so most people buy an existing home or rent an apartment instead.

Let's have a brief overview of its pros and cons before we move on to discussing the details.

| Pros |

Cons |

| You can be confident about the quality of materials used in the construction. |

High-quality materials tend to be expensive. The better the quality is, the higher the cost may be. |

| Everything has been customized to meet your requirements. |

Getting everything in accordance with your preferences and demands may be a time-consuming process. |

| You can avoid the seller's market and its competition. |

Building a house requires complete involvement and is, therefore a demanding process. |

Why SHOULD you build a house?

- Every three out of four homes built in the late 90s used lead-based paints. By building your own home, you can make safer choices regarding what goes on your walls and in your gardens (especially if you have children or pets.)

- You guessed it right, depreciation on a newly built home is ZERO! Why is this so important? On average, a homeowner spends about $3,000 every year on maintenance. Given that the house is built right, a homeowner can easily circumvent an additional $250 expense every month.

- House Hunting can be overwhelming and cause delays in finding the right home for yourself. Building a house allows you to outmaneuver the seller's market and bypass the competition that comes with it.

- The greatest plus point of building a house is the freedom to customize it. Whether you want a large garden or have a Jacuzzi in your backyard, the house is your canvas. Although customization may require significant money and effort, many individuals still favor it over having their home built according to someone else's specifications.

Why might you want to RECONSIDER building a house?

- The construction of a home is a whole other ball game. From hiring an architect to finding a contractor and paying for materials, it would seem like the money flows out of your pocket.

- Unexpected delays and contractor-related issues may arise while building a house. Ideally, a home should be constructed in eight to twelve months, but there is always a high chance of time extensions.

- Building your own home makes you the sole stakeholder in the house. To avoid fraudulent activities, it would be best to be fully involved in the building process.

- Time is not the only overrun. While you plan on incorporating your entire checklist of preferences, you can face expenses you should have budgeted.

What are the hidden expenses involved in building a house?

According to the US Census Bureau, the median price of a new home built and sold in 2023 is $438,200. However, about 20% of the cost of building a house is the cost of land. Building a house would be a much cheaper option for a far greater value if you own a piece of land and want to construct a house on it.

- Without any doubt, land makes up a huge portion of the house cost. While land prices have increased nationwide, southern states, such as Texas, have a lower cost of living, and the cost of land is still comparatively affordable per acre. Remember that the precise cost of land is predicated on the location. Typically, land costs in northeast Texas are higher but cheaper on the western and southern sides.

- Building a house from the ground up requires preparing the land, laying the foundations, and moving on to framing if necessary. Framing is essentially building the skeleton of the house. This forms a huge chunk of the cost of building.

- A newly built home will have to have installations from scratch. Electrical wiring, plumbing, and ventilation are all part of the installation. As a safe bet, you should keep aside $60,000 for installation costs.

- Finishing costs include everything from fixtures and fittings to painting and installing windows. This is where the house gets into shape (and so does your bank balance).

- In rare cases, home buyers may also be architects themselves. In most cases, they need to hire an architect for their customized endeavor. This certainly adds to the overall cost.

The Big Question: Should You Build or Buy a Home?

Every individual on their journey to homeownership comes from a different place. It is impossible to draft a guide that is both general and suited to your unique situation. Whether to build or buy a home is a personal choice and comes with risks, depending on how you take on this task. We have some tips for you:

Buying vs. Building a House: Last Minute Tips

Remember the three words before you say 'yes' to buying or building a house: COST, CONVENIENCE, and SATISFACTION. Considering costs, you can either build your dreams or buy convenience. Regardless, as long as you are satisfied, your choice does not matter.

Finally, ask yourself the following questions:

What do your finances look like?

Whether you embark on a house hunt to buy an existing house or search for land to build a house, you must thoroughly assess your finances and identify the costs involved in buying a home. Invest time and money by hiring professionals to assess your financial health before deciding between buying and building a house.

Are you a first-time home buyer?

First-time home buyers usually need to gain more knowledge about real estate in their area. They may be better off buying an existing home to avoid getting trapped in challenges right off the bat in their first home-buying experience.

Do you have enough time on your hands?

Building a house demands undivided attention. It is much like a newborn child you cannot ignore if you want it to grow well. Carefully assess if you can dedicate around six months of your time to monitoring and managing your house.

Are you a handyman?

The greatest cost involved in building a house, in addition to the costs that cannot be avoided, is the cost of finishing. If you can cut some of the finishing costs by taking over the tasks yourself, you might save A LOT!

FAQs

1. What Do I Wish I Knew Before Building a House?

Before building a house, there are crucial factors to consider that could save you money, time, and effort in the long run. These include:

- The location significantly affects the property's value and construction costs.

- The size of the house determines the overall expenses and functionality.

- Prior knowledge of contractors, the market, and materials levels the playing field.

- Your wish list can impact expenses, so be prepared to make adjustments if it exceeds your budget.

- Expect unexpected delays and conflicts during construction, and consider involving a construction attorney.

2.Is it More Cost-Effective to Buy or Build a House?

The cost-effectiveness of buying or building a house depends on your personal finances and budget. Consider the following steps:

- Identify the total cost profile of each option in your area.

- Determine your affordability based on your spending capacity.

- Set a cost limit that allows for unexpected expenses while staying within your budget.

3. Which Part of Building a House is the Most Expensive

Two of the most expensive aspects of building a house are framing and finishing costs. These costs depend on factors like the house's size, materials used, and specific buyer preferences. Framing brings the house's structure to life, while finishing adds the final touches and colors.

4. Is It Cheaper to Build or Buy a House?

The cost comparison between building and buying a house is not a one-size-fits-all answer. While building a house may involve higher initial costs, it can provide better long-term value compared to buying a house that needs costly renovations or repairs. The choice between the two depends on individual preferences and priorities, such as proximity to amenities and established neighborhoods.

5.What Are the Key Considerations When Deciding Between Buying and Building a Home?

When deciding between buying and building a home, consider the following:

- Assess your financial situation and budget for the entire cost profile.

- Evaluate your affordability, considering your debt-to-income ratio if you're taking out a loan.

- Set a cost limit while remaining flexible for unexpected expenses.

- Weigh factors like location, customization, proximity to amenities, and your long-term goals in homeownership. Consider what matters most to you in a home.

Still not sure whether buying or building a house is the right choice for you? HAR can help you weigh your options by providing access to a wide range of real estate listings and qualified realtors. Start your search now and make an informed decision!

To post a comment on this blog post, you must be an HAR Account subscriber, or a member of HAR. If you are an HAR Account subscriber or a member of HAR, please click

here to login. If you would like to create an HAR Account account, please click

here.

Disclaimer : The views and opinions expressed in this blog are those of the author and do not necessarily reflect the official policy or position of the Houston Association of REALTORS®