10 Products Bucking Inflation Trends

US inflation is extremely low by historical standards. But that low average masks a trend of sharply rising -- and falling -- prices for some products.

For decades, US consumers have enjoyed a relatively low inflation rate at 2-3% on average.

After an ugly period of high inflation in the 1970s and early '80s, policymakers seem to have the problem of rising prices largely under control.

But some items, mostly driven by investor and global consumer demand, have tipped the scale in record price increase percentages.

'The CPI is based on a broadly measured basket of goods which has risen in price by a modest 28% over the past decade and 64% over the past 20 years. Still, some prices have risen far faster, while other products actually have seen their prices fall in recent years.'

Gasoline-Up +131%

According to the U.S. Energy Information Administration, gasoline cost an average of $3.54 a gallon in February 2013 -- or about $71 for a 20-gallon tank. That was up 131% from a decade ago, when gas cost $1.53 a gallon, or $31 for the same size tank.

Gold-Up +371%

According to online precious metals tracker Monex, the value of gold has soared from $350 per ounce in 2003 to about $1,650 per ounce in mid-February 2013. That's an inflationary bump of 371%.

Coffee-Up +160%

In 2011, wholesale coffee bean prices exceeded $3 per pound for the first time in more than 30 years after spotty harvests of high-grade Arabica beans. The slackened supply was coupled with an increased thirst for gourmet coffees among middle-class consumers...According to the International Coffee Organization, the composite wholesale price for coffee was 51.9 cents per pound in 2003. In January 2013, the price was $1.35 per pound -- an increase of 160%.

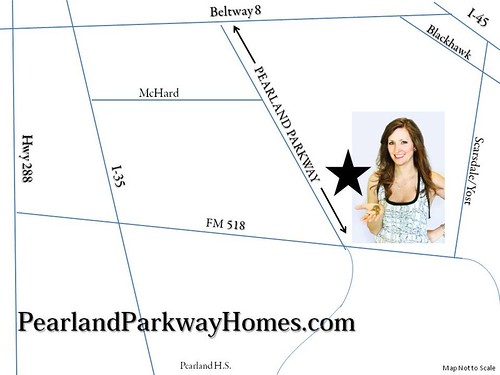

Has the Price of Your Home Been in Line with Inflation? Click Here to Find Out.

Eggs-Up +70%

In 2002, a dozen eggs cost an average of $1.18, and in 2012 that same carton ran $2.01, according to the Bureau of Labor Statistics. To find out why eggs have been in the midst of 70% inflationary hike, we head back to another lesson straight from freshman college economics class: the rising cost of production.

Razor Blades-Up +80%

Televisions-Down -56%

In 1997, a 28-inch Samsung color TV was priced around $750. In 2012, a 32-inch Samsung LED TV ran consumers $330, according to Target.com -- a deflationary rate of 56%. This is largely due to mass innovation causing the producer to be able to lower the price.

Movie Rentals-Down -40%

From $5 a movie back in 2000, to $2.99 most recently on average due to increased technologies.

Natural Gas-Down -39%

In January 2003, natural gas cost about $196.31 per 1,000 cubic meters. In January 2013, the price was about $119.78 -- a deflation rate of 39%, according to the website IndexMundi, which tracks commodities. In October 2005 the cost was $490.82! Milder winters are said to have created less demand. In addition, other countries have found their own sources.

Cell Phones-Down -90%

By 2012, you could get the most advanced smartphones for about $399, a price decline of 90% from a whopping $4,000 in 1983. Just as with other electronic devices, early innovation drove prices high but as more comparable products flooded the market, prices soon were driven down to fit the budgets of ordinary consumers.

Computers-Better and Cheaper

in 1977, an Apple II computer with 48KB of memory would have cost you $2,638, according to Geekosystem. That's $10,000 in 2012 dollars.Today a faster, lighter and more user-friendly 13-inch MacBook Pro costs $1,499. Windows-based PCs, which generally aren't as expensive as Macs, have fallen even more in price.

Original Story at MSN.com By Bill Briggs, SwitchYard Media

Search All Houston HAR MLS, Pearland MLS, Friendswood MLS League City MLS and Texas MLS Here.