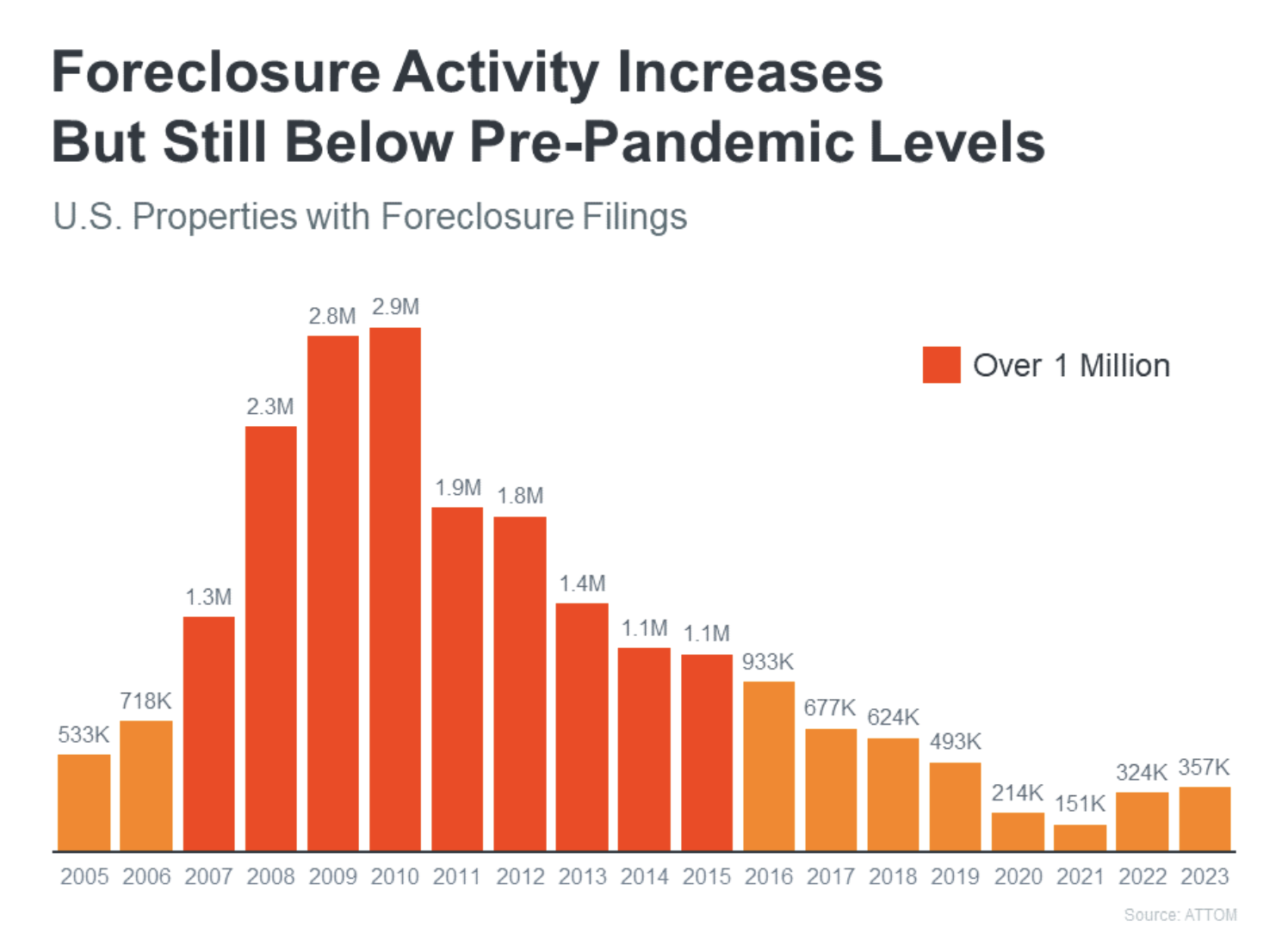

If you’ve been concerned about recent headlines regarding foreclosure rates, you’re not alone. But let's put things into perspective. At The Freund Group, we’re here to shed some light on the current situation in the re...

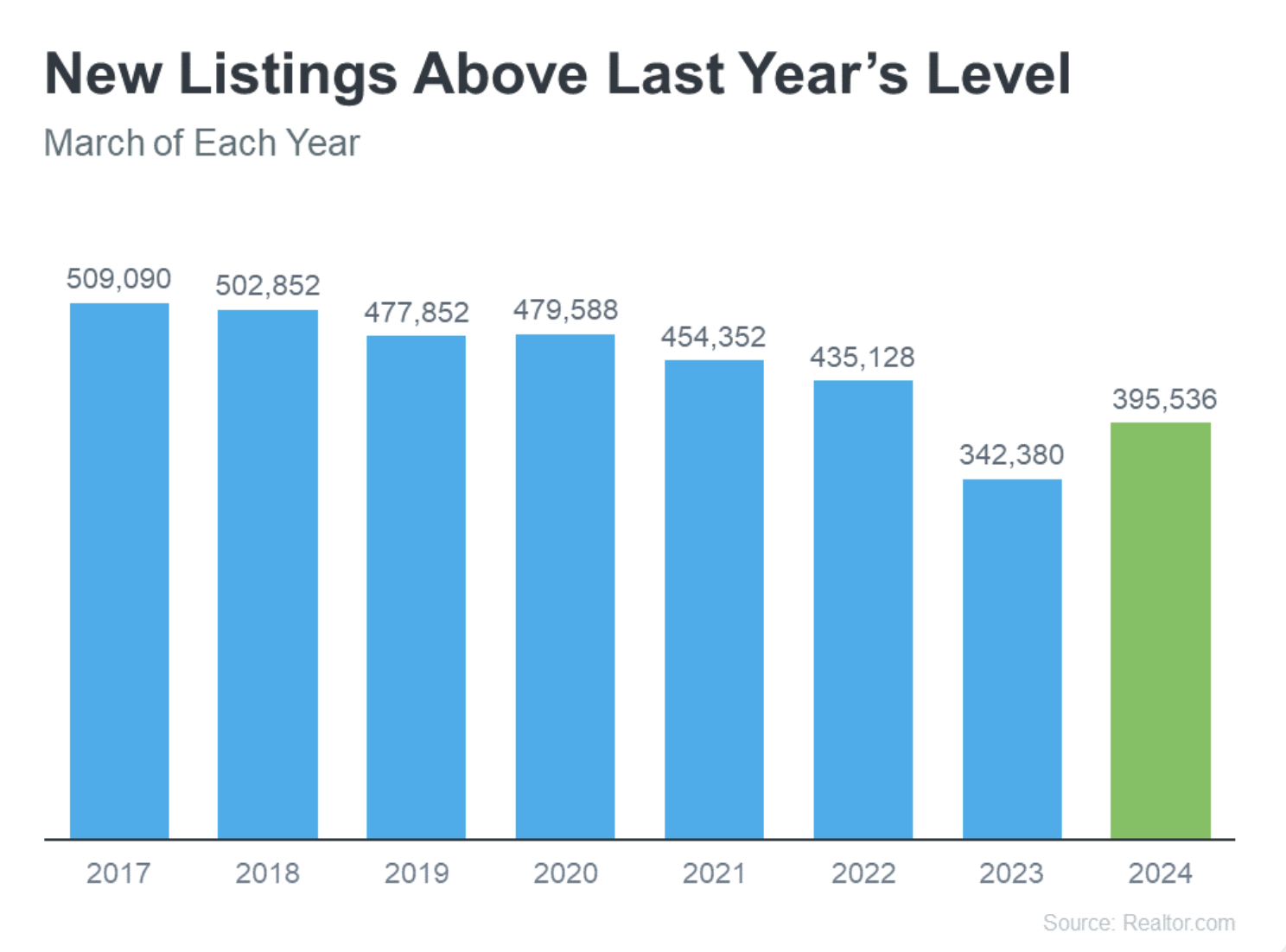

In today’s housing market, the number of homes for sale is a key factor to consider when making the decision to sell. As The Freund Group, your local real estate experts in League City, TX, servicing the Houston to Galveston area,...

Rather than delving into the intricacies of economic indicators, consider consulting with real estate professionals. They possess the knowledge and experience to interpret market conditions and provide valuable insights tailored to your...

Spring break for the Houston and surrounding areas is approaching quickly. If you are lucky enough to have some time off spend it with the kiddos. Make it a staycation and visit some of the fun and ex...

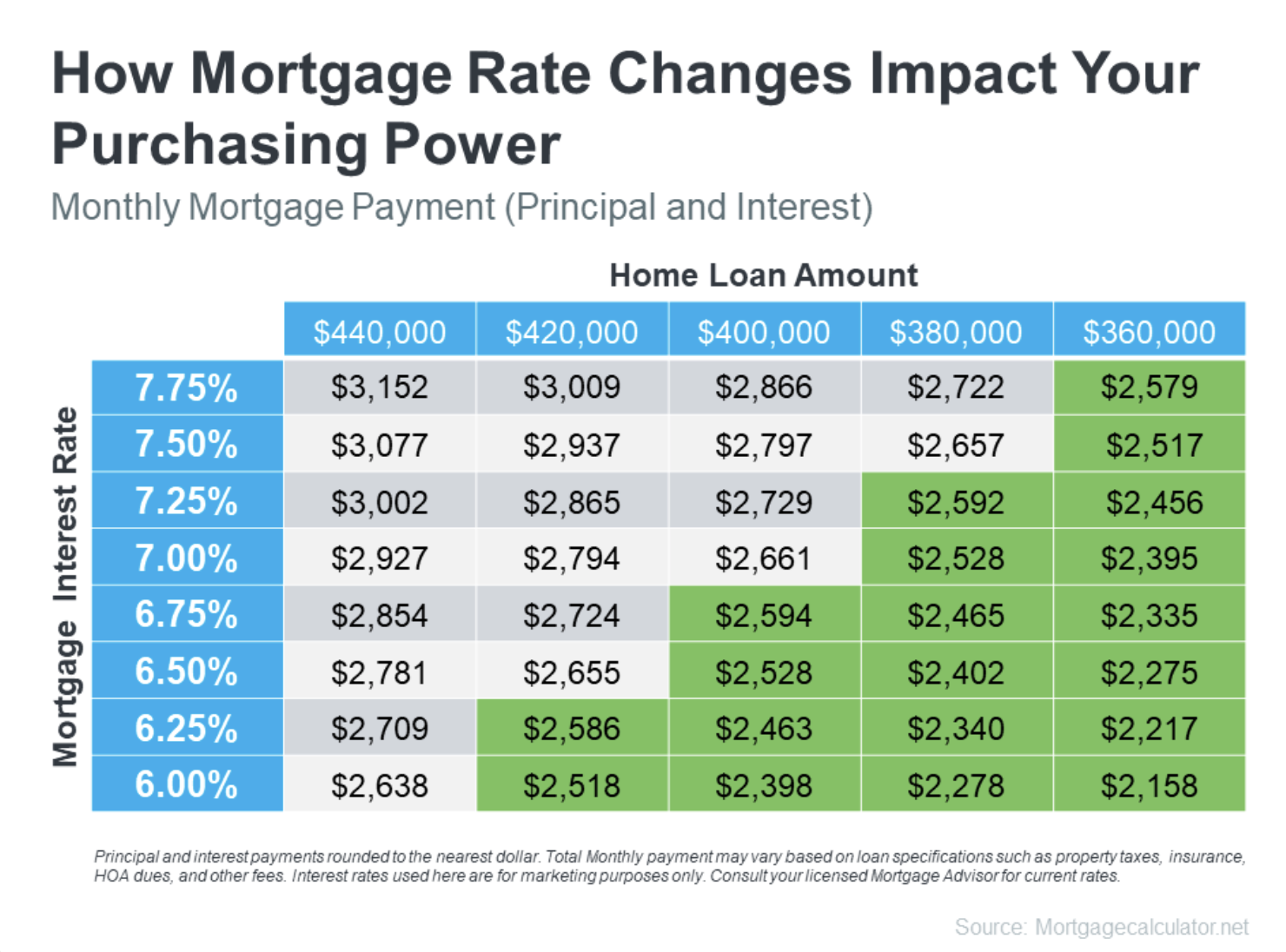

Many have asked the question “How do I buy a house in this hot market that we...

Pre-Qualification/Pre-Approval

Pre-Qualif...

...

...